Insurance Crisis In Florida: Waterfront, Airbnb’s & Flood Insurance

Here is my edited version with improved phrasing and grammar while maintaining the same overall length:

Insurance Crisis In Florida: Waterfront, Airbnb's & Flood Insurance

Florida homeowners insurance in 2024 is unlike anything we've ever experienced!

In this post, we will discuss waterfront houses in Sarasota, the Airbnb situation, and something that caught everyone's attention after Hurricane Ian: flood insurance. Who needs it? What's a flood zone? Can it derail a transaction?

I partnered with Julia Dees, an insurance agent specialist, who provided me with all those answers, and I will share them with you now.

Waterfront Properties

When we consider the types of waterfront homes, their construction year, size, and luxury finishes, we know we will have a wide range of insurance premiums.

It's common to see those figures ranging from low single thousand digits all the way up to $70,000 a year for their policy.

So, what are some of the main key factors people looking to purchase something on the water should know?

Besides the risk, you must also be aware of the home's age, its exact location on the water, the access to carriers around it, how much personal property you will have, the cost to rebuild the structure, etc.

Let's use two luxurious homes to compare these factors.

Located in Bird Key, the first home is a $4M property built in 2014 with 3,800 square feet, while the second one is a $2M property built in 1962 with 2,190 square feet.

For the 2014 property, the cost estimator gave an insurance premium rate of $7,900. The coverages include a dwelling cost of $1.2M, which is not related to the coverage of buying the house or the land but the cost to rebuild it.

While this price is already higher, the situation worsens for the 1962 property, which has a cost estimator of $14,000, double the price even though they are both located in the same area.

This happens because we are talking about an older home with an older structure with more risks than a newer one. The dwelling coverage for this home is less than the other one, around $950K to replace the actual structure. Besides, fewer companies are willing to accept a home of this age.

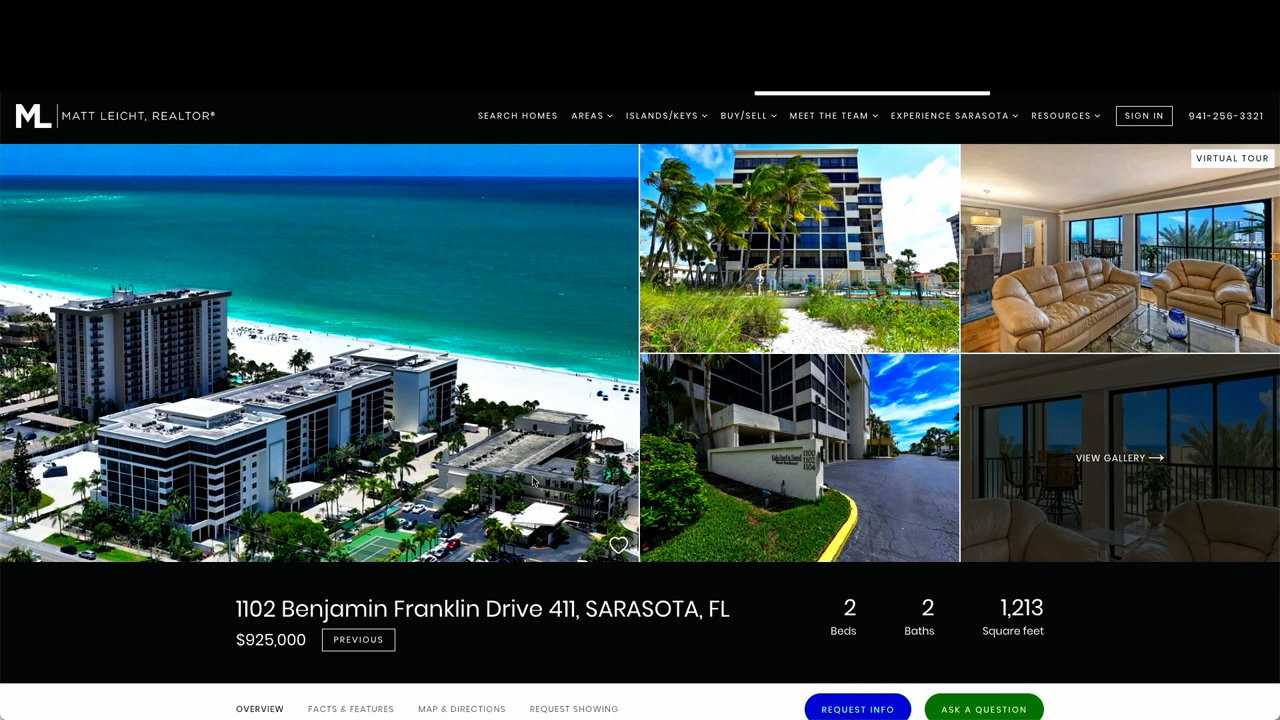

Moving the perspective to condos, I'll use a Lido Key home as an example. Built in 1976, it is 1,200 square feet, listed for $925K, with an insurance quote of $1,600.

What makes condos different from other houses is the drywall on the walls. Usually, the condo association has the master policy for the actual building structure, and that's where you will see the dwelling coverage.

This dwelling coverage will be different since it will only cover the drywall, including your floors, ceilings, and anything attached to it, making it less than expected.

However, when we look at a luxurious condo, we will be paying more of a luxury price on the premium insurance to replace all the finishes. So, for example, if you buy a $2M condo unit, the insurance premium will probably be around $3,000.

Airbnb Rentals

Now, let's discuss the insurance situation when we talk about Airbnb and short-term rentals.

First, it's the evaluating risk. The more people you have coming in and out of your place, the more risk you have. Those constant entries and exits make insurance rates increase more than having someone rent the place annually.

When you buy a house and contact agents to have your insurance policy, you must answer questions about its usage. Usually, if there is going to be any rental exposure, you will receive a renter's policy.

However, some insurance fraud can happen when someone buys the house, claiming it will be a secondary home, but turns it into an Airbnb and doesn't tell their insurance carrier. The buyer will not be covered in this case since they wouldn't have the right policy.

It is important to know how big of a risk this is. If you buy a home and decide to turn it into a short-term rental property, you must inform your insurance carriers to ensure you update your policy accordingly.

Looking at the Lido Key condo as an example, if the homeowner decides to make it a six-month rental home and asks for a renter's policy, the rate of $1,600 could reach up to $3,000, but it really will depend on the frequency of people coming in and out.

Flood Insurance

You probably saw clickbait about needing flood insurance to buy a house in Florida. But is this true? According to Julia, no. You do not need to have flood insurance if you want to buy a home within the state.

What happens with flood insurance is that it is shifting from generalized flood zones to ratings specific to the individual structure, something that is better for the homeowners.

They are getting the appropriate rate for the house they live in, whether it's required or not. The truth is that it's up to the lender to decide. Rates are built from the individual risk and not by the flood zone.

But what is this flood insurance we see people talking about, and what does it really cover?

Flood insurance covers mainly rising water from the ground up. People often use the word "flood" when they leave, for example, when their bathtub is overflowing, and water is flooding the house, but this is not what it is.

Even if you have a hole in your roof in the middle of a hurricane and water comes in, it still comes from above, so your flood insurance policy wouldn't cover that. Knowing where your flood insurance would and wouldn't kick in is important.

So, what do you do when you have a situation such as Hurricane Ian, and you aren't in a designated flood zone, don't have flood insurance, but your house gets damaged?

Unfortunately, there isn't much you can do, and you will need to pay out of your own pocket.

Even though flood insurance is not obligated, it is something important to add when you buy a home and get your quote; otherwise, you will need to wait over 30 days after something like Hurricane Ian happens to be able to have that type of insurance.

At the end of the day, it is important to have somebody who knows the area, understands the risks, understands and has access to companies, especially if you are moving to Florida from up north.

You can contact Dees Insurance for more information if you need help with insurance rates. They are an independent insurance agency based in Sarasota covering the whole state of Florida with almost 12 years of experience in the field.

You also need to find a local agent who has access to the top-rated carriers, knows what they're doing, has the processes in place, and ensures that you get what you need.

I can be that agent. So, if you have more questions or are already looking for a house and need help, my team and I would love to jump on a call with you and assist you every step of the way. Make sure you reach out to me at:

Email - info@mattleicht.com

Cell - 941.256.3321

If you have just started researching Florida, I have the perfect resource for you. All you have to do is click here to download my Sarasota relocation guide, a one-stop shop that breaks down the different areas and lifestyles of the region.

You can also subscribe to my YouTube channel for updates on lifestyle, real estate, and so much more in Sarasota, Florida.

Posted by Matt Leicht on

Leave A Comment