What is Homestead?

One of the greatest benefits to owning a permanent home in Florida is the ability to homestead your primary residence. I work with many Buyers who are purchasing a primary residence here in Florida and I consider educating them on homesteading their property an important part of my job. Unfortunately, I’ve seen many people miss the mark when it comes to doing this, simply because they lack the knowledge on what it can do for you or they just don’t know about it! This simple job can save you hundreds of dollars each year in taxes. Consider this your guide to homesteading your property; as I’ve personally experienced this on my own home, educated many clients along the way with their homes, and have seen the fantastic benefits of Florida living!

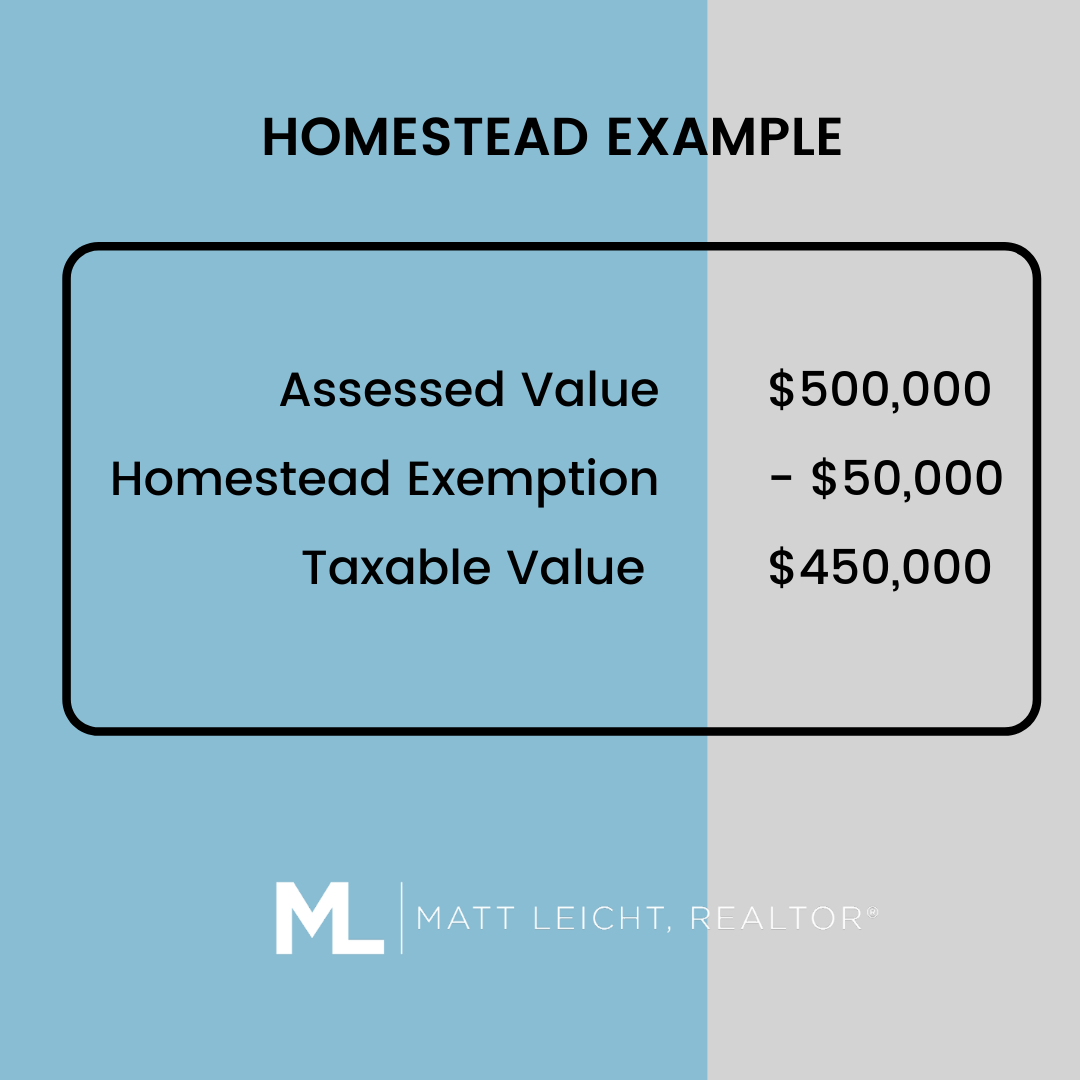

Simply speaking, homesteading your property will give you an additional $50,000 reduction on the assessed value of your property and save you around $800 in taxes per year. Saving $800 in taxes is great, but it gets better! When your property is homestead, your property taxes are not allowed to increase any more than 3% from the previous year. Let’s say you were paying $4,000 in property tax... the most it could go up the next year would be $120. So the next year you could be paying $4,120.

How Do You Homestead?

Homesteading a property is very simple once you obtain all the documents needed. You can typically do this online or in person. Here in Sarasota, you can complete it online through the Sarasota County Property Appraisers website. Or, you can head downtown to the Sarasota County Property Appraisers office to do it in person. The following documents are needed in order to homestead: driver's license, voter registration card, property deed, and social security number. All these documents must show the current address in which you are trying to homestead.

Can I Transfer my Homestead?

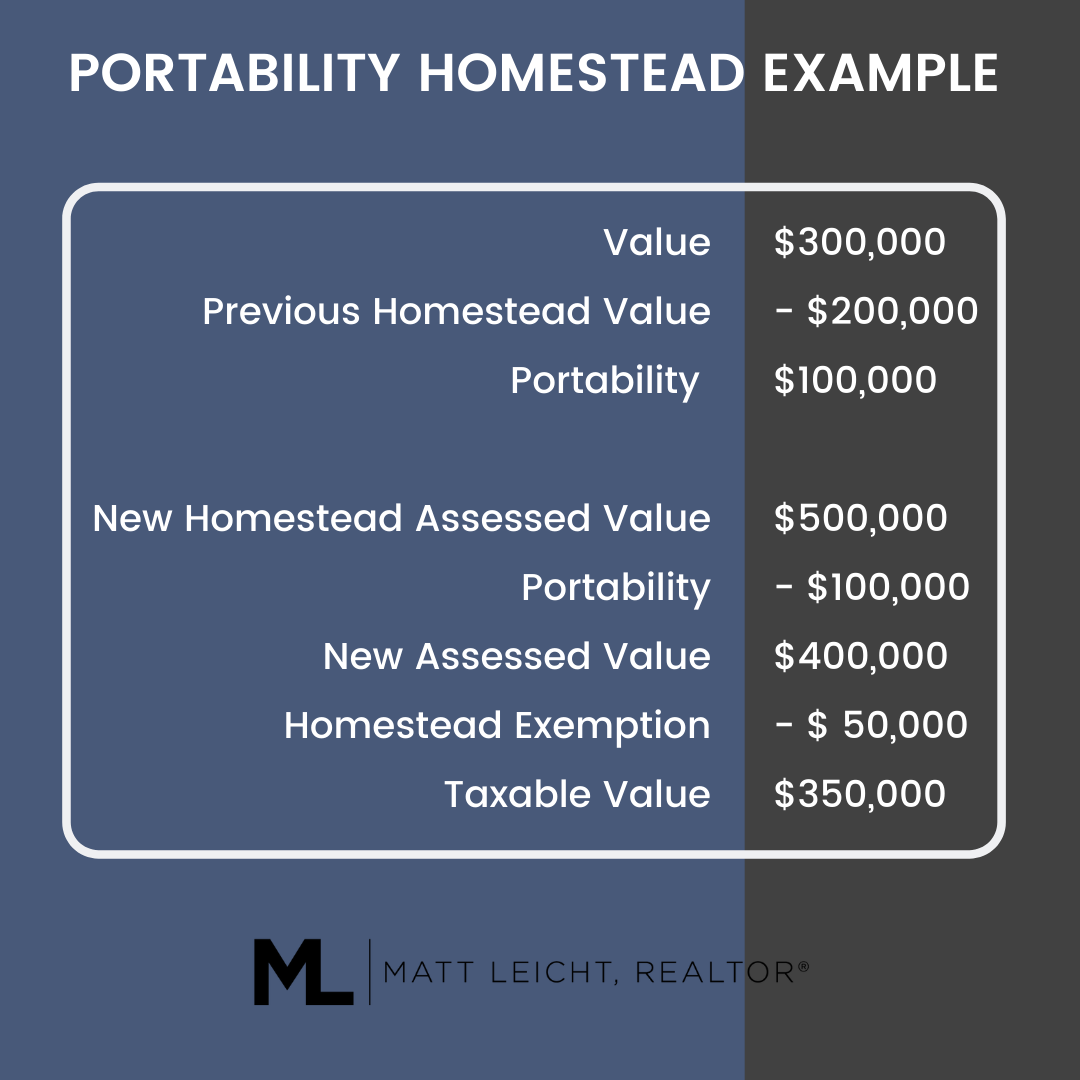

YES! This is called portability. Portability allows you to move your homestead from one property to another. How is portability calculated?

Subtract the assessed value from the market value of the previous homestead. That is your portability amount. Take the portability amount and subtract it from the market value of your new homestead. That equals your new assessed values.

Example: *Values are based on the Certified Value as of January 1 Previous Homestead Market/Just keep in mind, when applying for a new homestead, the market and assessed values are equal.

Leave A Comment