Florida Closing Costs

How much are closing costs in Florida? I get asked this question from my clients quite a bit, so I’m going to guide you through about how much you’ll pay in closing costs whether you’re buying or selling a property here in Florida.

Closing costs are sometimes forgotten in the hype of picking out a home or moving on from one. But it’s important for you to budget in closing costs before making a decision to buy or sell a home, because you will have to pay them one way or another! Watch my video below or read the blog to learn all about closing costs in Florida!

Buyer Closing Costs in Florida

There are a few different things that go into a closing cost for a Buyer here in Florida.

Title Insurance

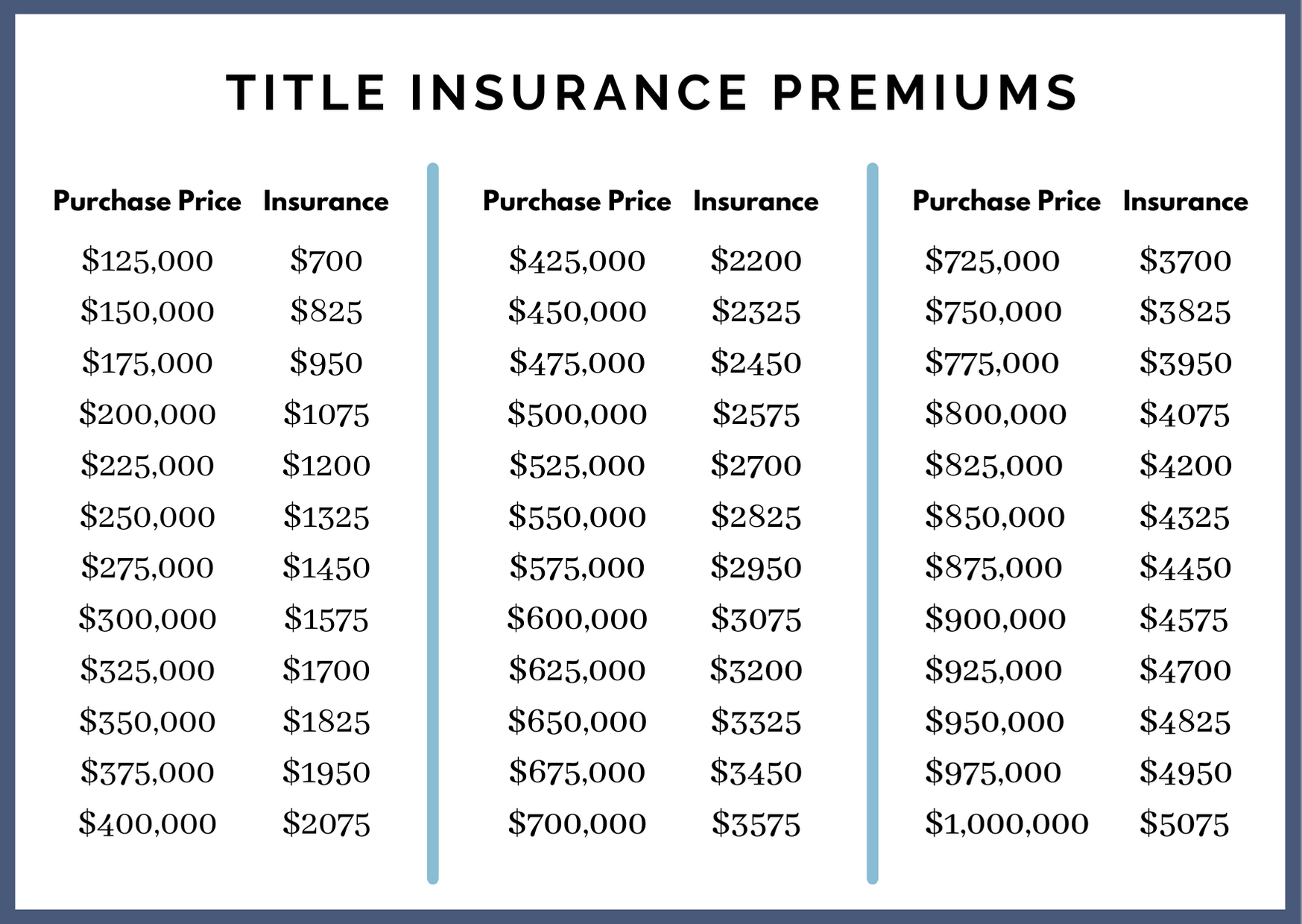

Every area/county can be different, but in Sarasota it’s pretty standard that the Buyer pays for their own title insurance on the property. This amount is pretty much set by the purchase price of the home. Below are some numbers provided from a real estate attorney in Sarasota on what they charge for title insurance based on the purchase price of the home. These should give you an estimate of what you will pay.

You are also going to have a lot of miscellaneous fees such as a closing fee, title search, a lien search, title endorsement, etc… These are going to be in the ballpark of $1,200 combined.

Loan Fees

If you are a cash Buyer, this doesn’t apply. But for Buyers that are obtaining a loan… there’s a lot more “loan fees” that are involved in closing as well. A few examples would be: Loan origination fee, Under writing fee, and Appraisal fee.

I have seen loan fees range from $1,200 up to $5,000 depending on the type of loan and if you need to purchase points in order to obtain a lower interest rate.

Prepaids

Prepaids are included in your closing costs. Buyers are expected to pay the proration of taxes as well as the insurance premium when the property closes.

Proration of taxes: This depends on what month you purchase a home in and what the current takes are on the home. For example, If the taxes were $8000 per year and your purchased in June. You would be responsible for paying months July – December, which would be $4,000 (since you owned the property for half the year).

Insurance: This again depends on how much the insurance policy is going to be. There are ways to lower the cost of insurance with discounts through things like a 4 point inspection or a wind mitigation. The best way to get an insurance estimate is to contact an insurance agent prior to purchasing a property to get a quote. Check out my blog/video here, where I interview a local insurance agent.

Example of Buyers Closing Fees

Purchase Price: $500,000

Title insurance: approx. $2,575

Closing fee/title fees combined: approx. $1,200

Lender fees: approx. $2,000

________________________

Total: approx. $5,775

*Plus the cost of insurance, proration of taxes, and proration of the HOA.

Seller Closing Costs in Florida

Sellers costs are much simpler here in Sarasota, Florida! Obviously taxes and HOA are prorated. But other than that a Seller will pay the doc stamp tax to the state of Florida, closing fees, the estoppel, and the real estate commissions.

Doc Stamp Tax

The doc stamp tax rate in Florida is $0.70 per $100. Every Seller will be required to pay the doc stamp tax to the state of Florida.

Closing Fees

There are various small closing fees that may also be collected. These can range from approx. less than $100 up to $500.

Estoppel

The estoppel fee applies to communities that have a Homeowners Association (HOA). It is a small fee ensuring that the Seller is up to date on payments and that there are no leans on the property. These can range from about $200 to $500 in this area.

Real Estate Commissions

In a standard contract agreement in the state of Florida, a Seller will pay 6% of the purchase price of the home in commission. 3% will go to the Buyer’s agent and 3% will go to the Seller’s agent.

Example of Sellers Closing Fees

Purchase Price: $500,000

Doc Stamp: $3,500

Closing Fees: approx. $200

Estoppel: approx. $200

Buyer real estate brokerage commission 3% - $15,000.

Sellers real estate listing brokerage 3% - $15,000

__________________________

Total: approx. $33,900

Whether you are buying or selling, it is always good to know the cost of the transaction and that includes how much closing costs in Florida are! Every transaction is different, so these numbers are simply an estimate.

As a Sarasota realtor, I do my best to educate my clients on how to best position themselves for the best possible experience when it comes to buying or selling a property. Please reach out with any questions and let me know if I can help you find or sell a home in the Sarasota area.

Leave A Comment